Cost Cutting in Big Tech

Big Tech needs to cut headcount, establish EBIT margin targets, cut unnecessary projects and buyback their stock at reduced prices.

About 3 weeks ago Brad Gerstner of Altimeter Capital put out a public letter to Mark Zuckerberg saying that Meta needed to streamline and focus on its path forward in the new operating environment. In the letter, he made three recommendations which he claimed would help double Free Cash Flow to $40bn/year:

1) Reduce headcount expense by at least 20%;

2) Reduce annual capex by at least $5 B from $30B to $25B; and

3) Limit investment in metaverse / Reality Labs to no more than $5B per year.

Two weeks later Meta announced that they are laying off more than 11,000 employees representing 13% of the company and extending a hiring freeze through the first quarter of next year.

Following in Gerstner's footsteps, Chris Hohn at TCI released a letter to Alphabet earlier today outlining what is becoming a common refrain in tech: reduce headcount, establish an EBIT margin target, reduce science projects and increase share buybacks.

Google's Search business has high operating leverage and is not labour intensive. Despite strong revenue growth, operating leverage has been minial over the last five years. In Q3 2022, total expenses grew 18% year-over-year while revenues grew on ly 6%. The EBIT margin of the Google Services segment contracted from 39% to 32% in Q3 as a result.

During a period of high growth between 2017 and 2021, revenues increased at an annual rate of 23%, cost discipline was not a priority. However, cost discipline is now required as revenue growth is slowing. Cost growth above revenue growth is a sign of poor financial discipline.

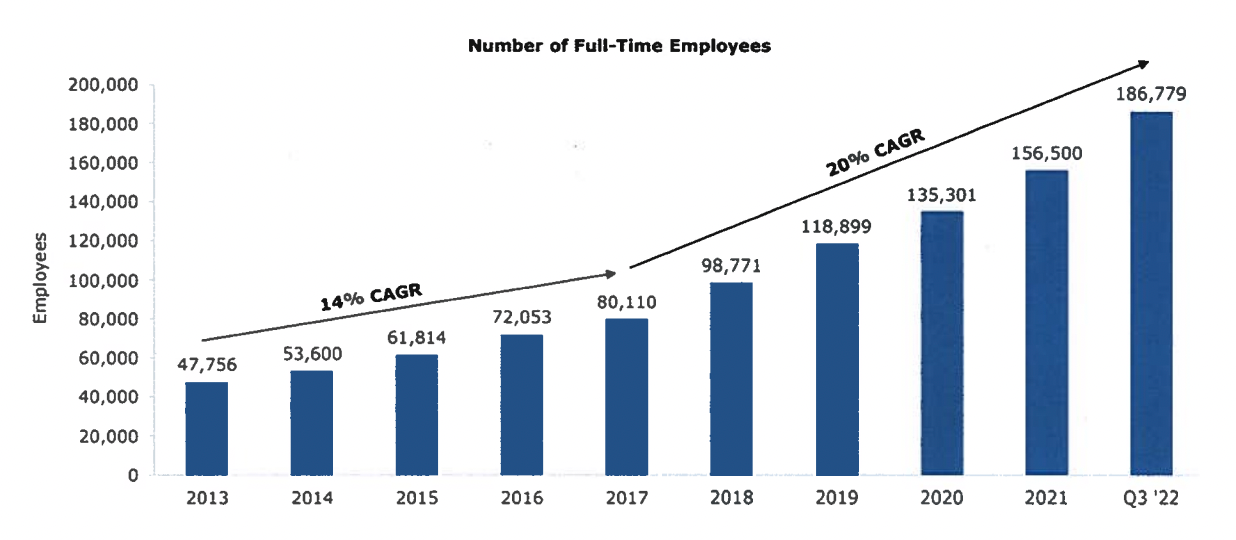

Headcount and Compensation – Hohn goes on to point out that Alphabet's headcount increased at an annual rate of 20% since 2017 and also doubled since then.

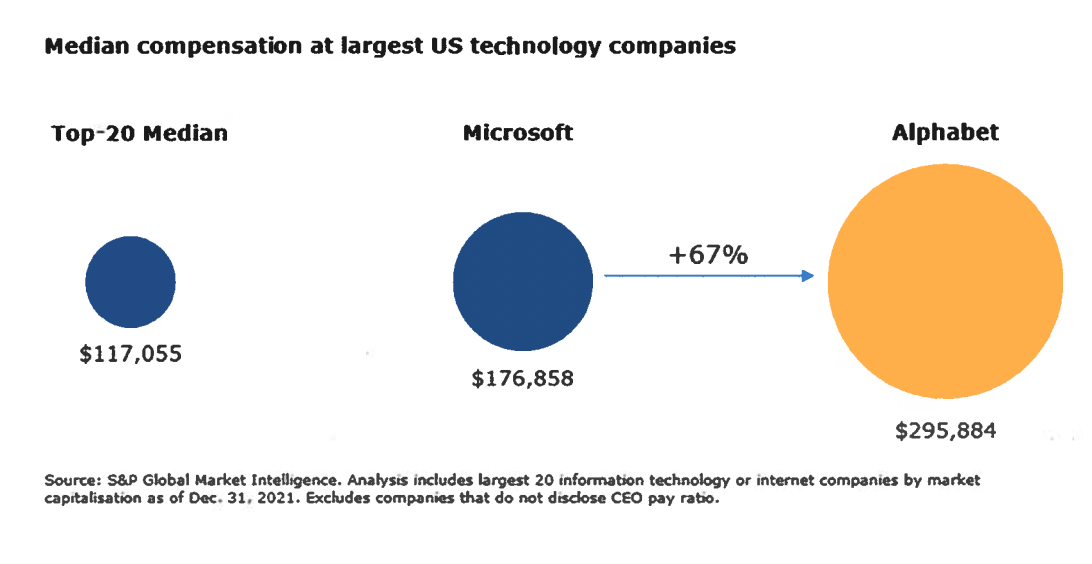

He also points out that Alphabet's median compensation is 67% above Microsoft.

Science Projects – In a zero-rate environment you have money to fund lots of different initiatives. The game on the field has meaningfully changed and Hohn says that they ought to cull the $20 billion in "Other Bets" which have so far been unsuccessful.

Share Buybacks – Taking a page out of the Ichan/Apple playbook, Hohn recommends that Alphabet use its $116 billion in cash to repurchase shares since their ability to use the cash for large scale M&A is "limited due to regulatory scrutiny" and at 16x 2023 EPS, the stock is "very cheap."

The bottom line is that as we continue to face macro uncertainty and a likely recession, companies need to think hard about cutting costs, establishing EBIT margin targets, reigning in excess spending on pet projects, and using cash balances to buy back stock at historically low prices.

h/t to @modestproposal1 for sharing the link to Hohn's letter.