"Buy The Dip"

Just kidding...don't.

After Russia invaded Ukraine, the US and her Allies announced sweeping financial sanctions:

Today, the United States, along with Allies and partners, is imposing severe and immediate economic costs on Russia in response to Putin’s war of choice against Ukraine. Today’s actions include sweeping financial sanctions and stringent export controls that will have profound impact on Russia’s economy, financial system, and access to cutting-edge technology. The sanctions measures impose severe costs on Russia’s largest financial institutions and will further isolate Russia from the global financial system. With today’s financial sanctions, we have now targeted all ten of Russia’s largest financial institutions, including the imposition of full blocking and correspondent and payable-through account sanctions, and debt and equity restrictions, on institutions holding nearly 80% of Russian banking sector assets. – White House Fact Sheet (Feb 24, 2022)

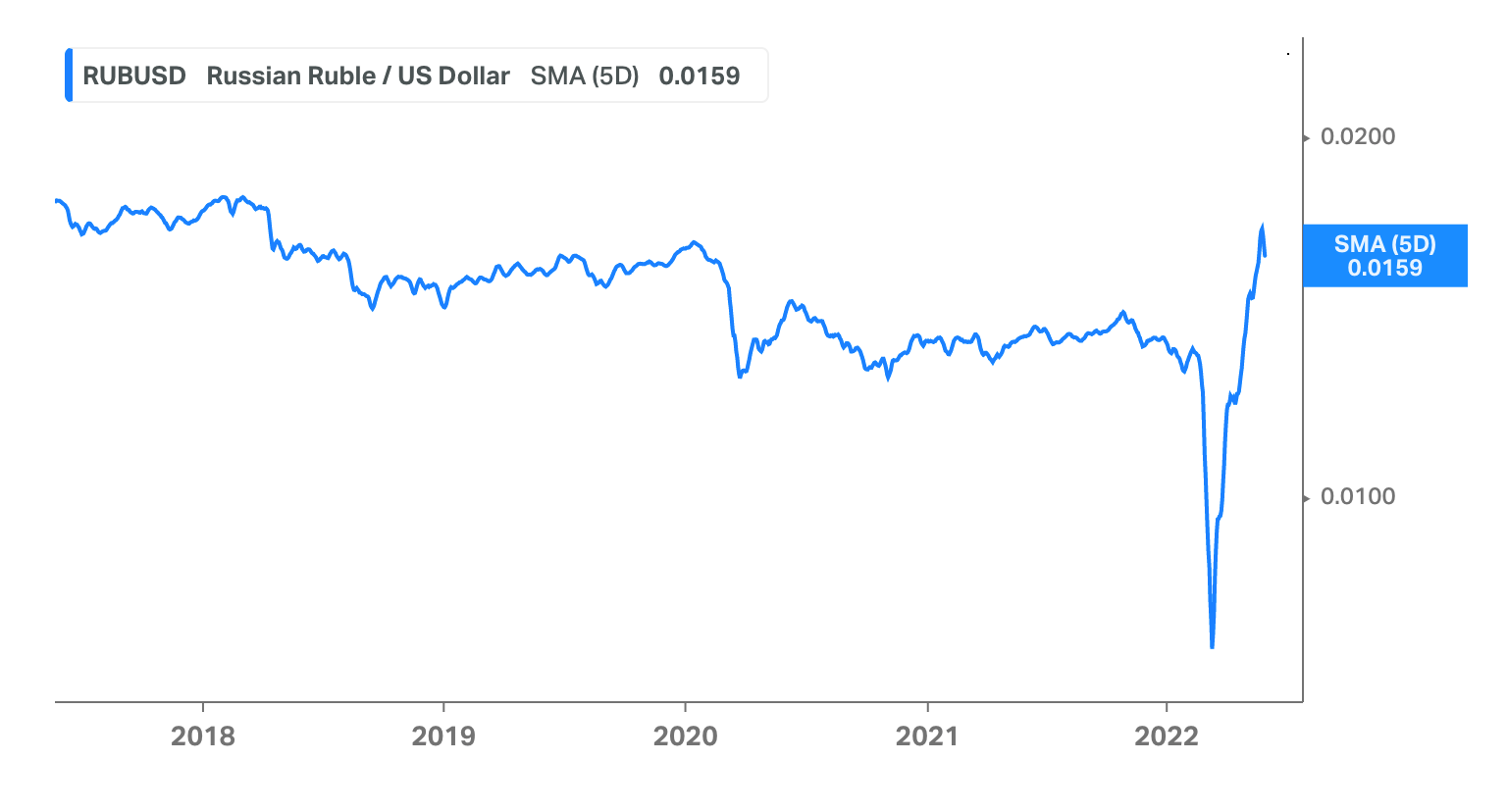

Given the magnitude of these economic sanctions, you'd expect that the Ruble would be significantly impacted and that is what the graph shows. Below is a graph of the Ruble/USD exchange rate and you can see that the sanctions caused the value of the Ruble to plummet.

However, what's surprising about the graph is the rebound in the value of the Ruble and today's WSJ has an article explaining how Russia has managed to do this:

- Russia capped the amount of dollars residents can withdraw from foreign-currency bank accounts

- Russia barred banks from selling foreign currencies for the next six months

- Russian brokerages can't let foreign clients sell securities

All of these capital controls have the effect of limiting the sell-off of Rubles which is artificially propping up the currency. Moreover, Putin is now proposing that European nations begin buying Russian gas with rubles rather than dollars or euros which would serve to impact the demand for Rubles since Europe is still funding the Russian war machine by continuing to import Russian gas and oil.

The impact of this is that you have limited the selling of Rubles and potentially increased demand for the currency since you'll now have to pay for Russian oil and gas in Rubles. As this EU fact sheet points out, the EU's energy supply is highly dependent on Russian oil and gas so stopping the importation of Russian ONG is out of the question:

The stability of the EU’s energy supply may be threatened if a high proportion of imports are concentrated among relatively few external partners. In 2019, almost two thirds of the extra-EU's crude oil imports came from Russia (27 %), Iraq (9 %), Nigeria and Saudi Arabia (both 8 %) and Kazakhstan and Norway (both 7 %). A similar analysis shows that almost three quarters of the EU's imports of natural gas came from Russia (41 %), Norway (16 %), Algeria (8 %) and Qatar (5 %), while over three quarters of solid fuel (mostly coal) imports originated from Russia (47 %), the United States (18 %) and Australia (14 %).

Turns out energy independence might have been a good idea after all.