Stock Printer Go BRRR!

Stock buybacks to offset dilution get you twice: first with dilution and second with non-economic repurchase. Oh and by the way you now have management teams with calls and puts in their stock option packages.

Jim Chanos on the perversity of stock-based comp:

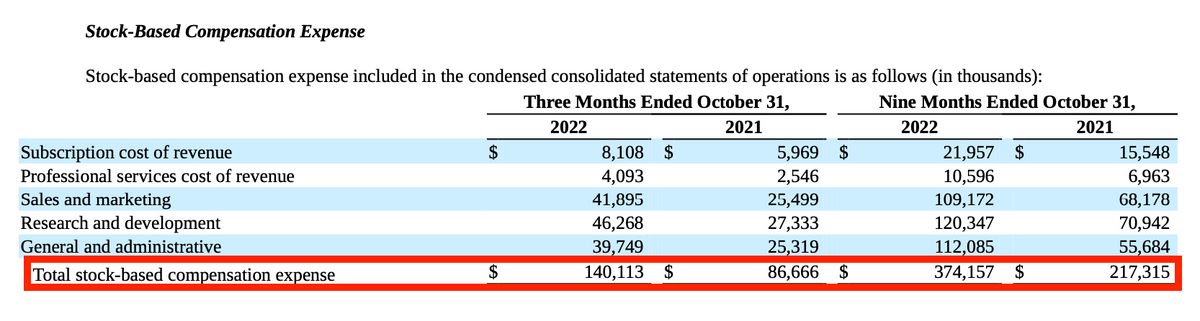

The post dotcom era, and back then it was stock option accounting that went under the microscope and ultimately had to be accounted for. And now of course, in effect it's taken out through the use of proforma adjustments, but what people found out was that it had just a tremendous procyclical effect on things. That is when your stock price was going up, you didn't have to issue as many shares for a given dollar level of compensation. And now that the stock is down, if your stock is down 80 or 90%, you have to just issue massive amounts of stock. So you're issuing more stock as it goes down, you're diluting people. So it becomes procyclical to the downside as well. And the numbers are now becoming meaningful. Uh, the company I mentioned just a few minutes ago that reported last night is got run rate share based comp of almost a half a billion dollars.

And based on their current share count, that means that, that the shares outstanding are gonna be going up something like seven to 10% a year just on the back of share base comp. The other problem is we've seen a number of companies beginning in the second quarter companies like DoorDash and salesforce.com and Zoom announced large share buyback programs to offset the dilution of the share base comp.

[...]

So you have the silliness of the share-based comp being excluded from the adjusted profit figures and actually being a positive for operating cash flow in the cash-flow statement. But yet now the substantial share buyback cost is below the line in the cash flow statement under financing. So it's skewed incentives in so many different ways, but it's getting worse. The amount of share base comp for some of these companies is actually going up faster than revenues. So they're on the treadmill, if you will and I don't know how they're gonna get off it.

And again, that's my view on the procyclical of all these kinds of developments. They make things look much better than they are on the way up and they really hit you pretty hard on the way down. And so it just increases the amount of volatility in given corporate assets.

There's one other aspect I will mention that your audience might not appreciate and, and we saw it in the dotcom bust, and that is if you have a lavish equity issuance culture and you have a compliant board that basically will agree to almost any management equity issuance plan, then when you issue stock options and various different equity instruments to your management and your employees, if the board's rubber stamp things well, they will rubber stamp repricing those equity awards if the stock goes lower or granting more if the stock goes lower to keep employees happy.

And what that means is, is that boards are acquiescing to not only call options, but they're granting put options to the employees and and management. And that's a frightening alternative because number one, the Black-Scholes model is only picking up the cost of the call options. And B, you don't really want a management team that has a bunch of puts in their stock as well as calls. And it's something that I don't think a lot of people pay enough attention to on the governance side that I think your audience might appreciate.

– Jim Chanos, Odd Lots on the Tech Bust, Crypto, and Fraud