Fidelity and BTC

Fidelity argues Bitcoin is fundamentally different from every other digital asset and it is best thought of as a non-sovereign monetary good.

The source and root of all monetary evil [is] the government monopoly on the issue and control of money. —Friedrich Hayek

Fidelity Digital Assets came out with a fascinating report in which they argue that Bitcoin is fundamentally different from any other digital asset. They argue that while there may be digital assets that excel for different use cases, Bitcoin is best thought of as a de facto non-sovereign monetary good.

Bitcoin is fundamentally different from any other digital asset. No other digital asset is likely to improve upon bitcoin as a monetary good because bitcoin is the most (relative to other digital assets) secure, decentralized, sound digital money and any “improvement” will necessarily face tradeoffs. – Fidelity Digital Assets

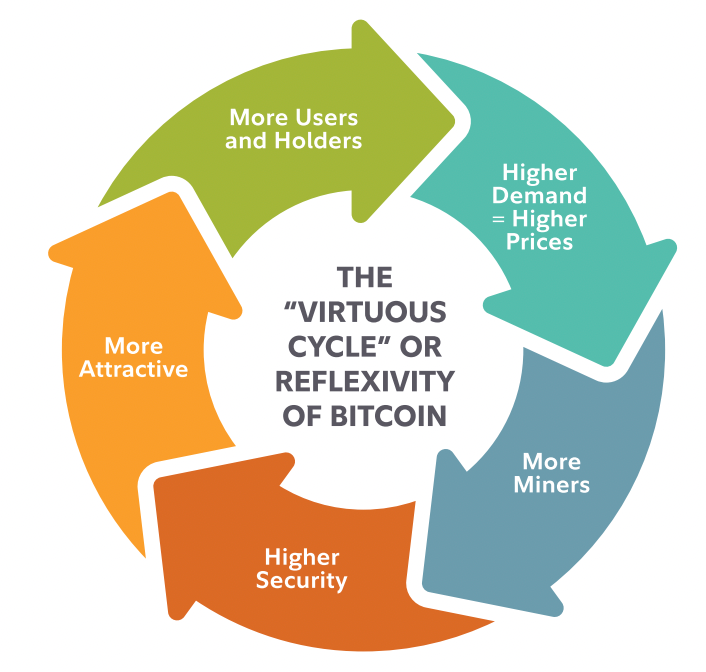

Bitcoin is a network and the success of the network is a flywheel. The success of Bitcoin set in motion a virtuous cycle in which – by nature of being the first crypto – people observe others joining the network which incentivizes them to join the network but also incentivizes miners to actively secure the network. The more people join the network, the higher the price of Bitcoin, the more miners want to mine the crypto, which leads to a higher level of security.

The authors are quick to point out that the success of Bitcoin does not necessarily come at the expense of other digital asset networks. Rather, these other projects "should be evaluated form a different perspective than Bitcoin." However, they emphatically argue that Bitcoin should be thought of as primarily a monetary good.

This brings us to the age old question, "What is money?"

At its simplest, money is defined as the generally acceptable medium of exchange. However, what is generally accepted varies both across geography and time. For example, rai stones were both highly valued and generally accepted as money by the natives of the Yap. However, a rai stone would not buy you a thimble of beer in Industrial England.

In his book Denationalisation of Money, F.A. Hayek points out that despite our best efforts to label money, there really is no clear distinction between money and non-money:

It also means that, although we usually assume there is a sharp line of distinction between what is money and what is not—and the law generally tries to make such a distinction—so far as the causal effects of monetary events are concerned, there is no such clear difference. What we find is rather a continuum in which objects of various degrees of liquidity, or with values which can fluctuate independently of each other, shade into each other in the degree to which they function as money. – Denationalisation of Money: The Argument Refined (LvMI) (p. 72).

Rather, it was Hayek's view that money is best thought of as an adjective which describes various properties that different items can possess in varying degrees. This flexibility is what enables rai stones in the Yap Islands and wampum in North America to be treated as money by their respective populations.

So what are the appropriate properties for determining where various items fall on the money spectrum? The St. Louis Fed had a great breakdown. Looking at various forms of money across time, they point out that the lowest common denominator for things that are used as money are the following:

- Money stores value. This means that if you earn $100, you will be able to purchase a roughly similar number of goods and services.

- Money is a unit of account. In short, money is supposed to be a yardstick. It's a way to calibrate the value that you've provided. Rather than denominating a computer in cows, money is the lowest common denominator.

- Money is medium of exchange. This means that you can trade goods and services for the money and that this form of payment is widely accepted.

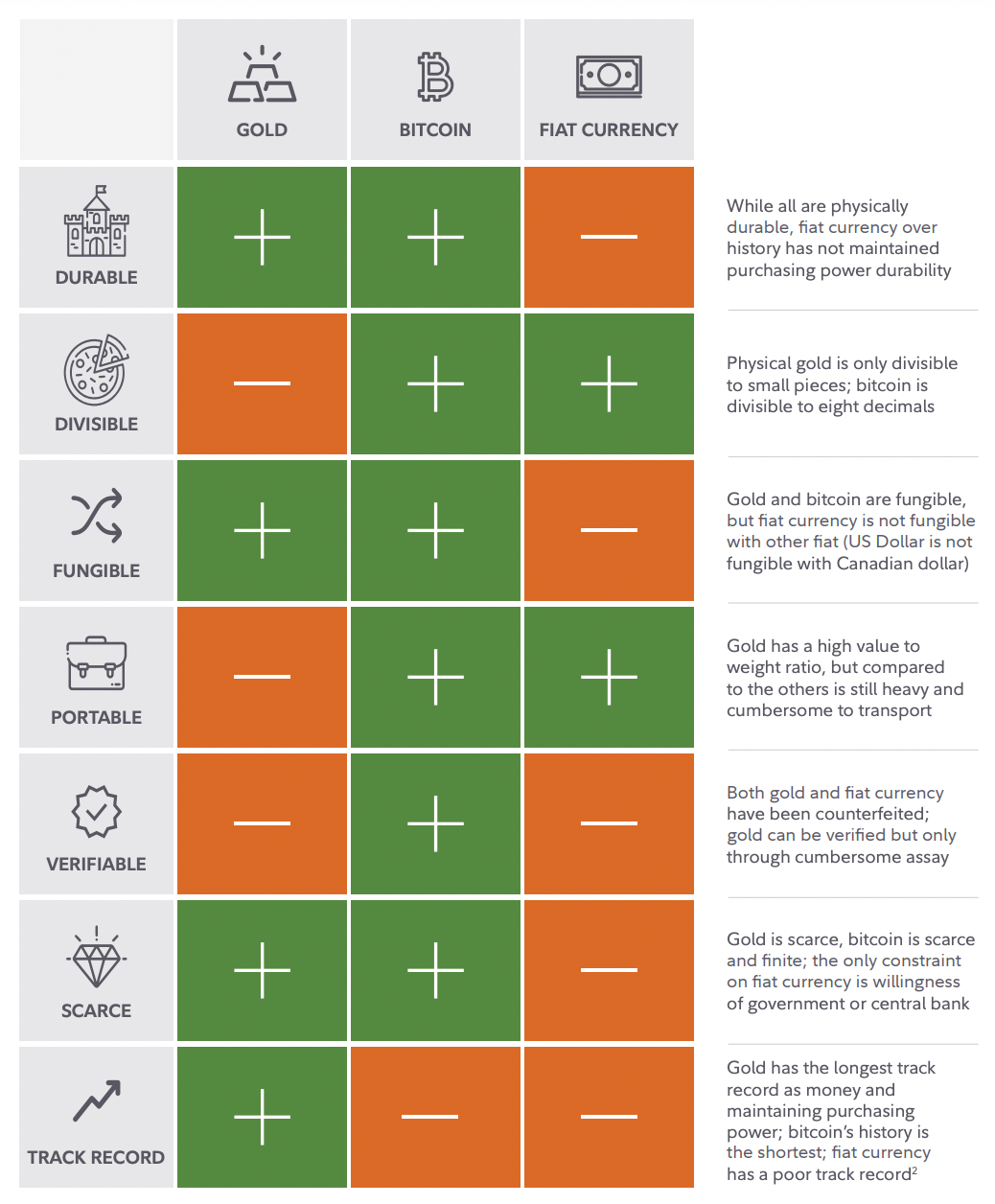

They posit that different forms of money make different tradeoffs across 6 different dimensions:

- Durability – Does it spoil or can it be used for a long time? Bananas rot while paper money does not.

- Portability – Is it easy to transport? Gold is hard to transport while paper currency is easy.

- Divisibility – Can you easily divide it? A coconut is not divisible while gold is.

- Uniformity – Is every unit of the money the same? All bananas are different sizes so that's not uniform while a set amount of gold is uniform.

- Limited Supply – Is there a finite amount of the money? Gold is finite since there is only so much gold in the world while paper money is infinite since you can print more.

- Acceptability – Do people take the money as remuneration for goods and services?

In the paper, the researchers at Fidelity run through this list and rate the three major forms of currency that we've seen throughout history: gold, fiat currency, and now Bitcoin across these dimensions (they also add a last property, track record, which represents whether a form of money has a good or bad track record over time).

The main takeaway is that as more people believe Bitcoin to be a legitimate form of money the more widely it will be accepted for goods and services. Some have called this a Ponzi scheme which is where investors are lured in and their funds are used to pay profits to earlier investors. The issue with this argument is that the same dynamic holds true with fiat currency. After Richard Nixon ended the dollar's convertibility to gold, we moved to a world dominated by fiat currencies and fiat currency derives its value from the fact that people believe that it is valuable because they can use it to pay their taxes. Put simply, people believe fiat currency is worth something because the government tells them that it's worthwhile.

Part of the reason that Bitcoin has not been top of mind for people in the United States is that over the past decade, we have been fortunate to have an extremely stable monetary system with low rates of inflation. People simply did not need to worry about confiscatory taxation via inflation. However, with the highest rate of inflation that we've seen in 40 years, people are starting to wonder whether the dollar is really where they want to put their money.

Do they want to keep it in a bank account which yields a near-zero percent interest rate while the cost of everything they want to purchase monotonically rises in price? Or do they want to hold Bitcoin which is provably capped and can never be inflated away by feckless, greedy politicians? Seems like an easy answer to me.