The Empire Strikes Back

How the IMF is trying to kneecap crypto.

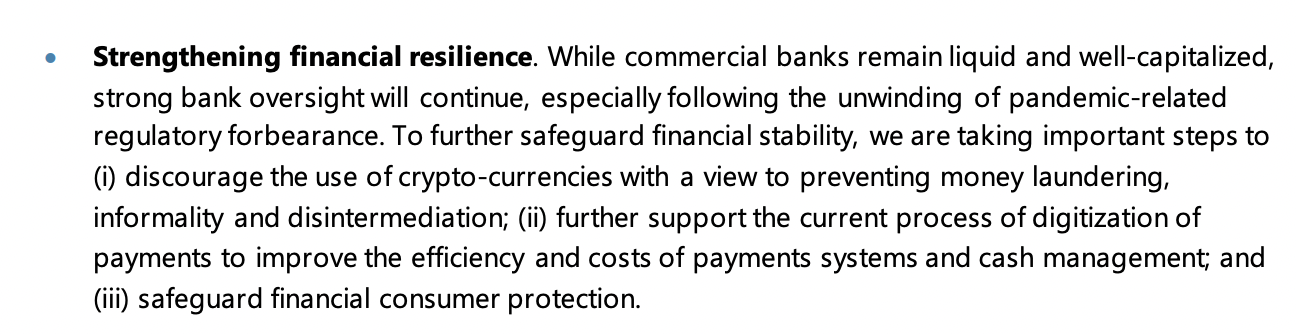

Yahoo! Finance reports that as part of Argentina's $45 billion bailout deal, the IMF conditions stipulated that the government strike an aggressive posture in order to "further safeguard financial stability":

Argentinean senators just approved a $45 billion bailout deal with the International Monetary Fund (IMF) on Thursday that will help the country avoid an imminent default on its debts.

But that’s not the unusual part of the agreement.

The deal, which was approved in a 56 to 13 vote, includes a wild provision that will force the government of President Alberto Fernández to take a tough anti-cryptocurrency stance.

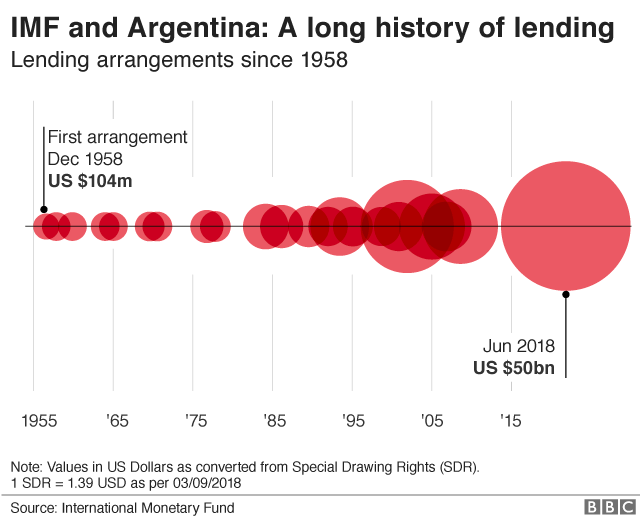

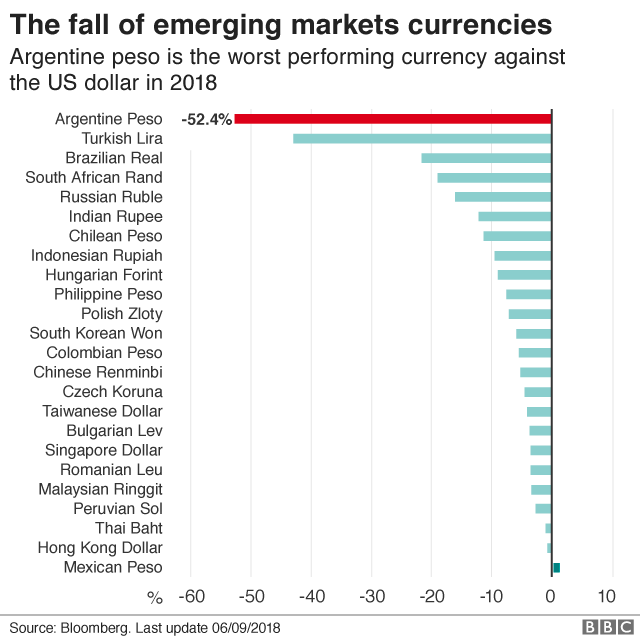

Argentina's 2018 crisis (of which this rescue package is related) is the most recent financial crisis is just the latest a long history of monetary troubles. Indeed, Argentina has defaulted on its external debt nine times since the country became independent in 1816 and has had a number of IMF loans since the creation of the institution in 1944.

Ordinarily it wouldn't be too interesting that Argentina ran into fiscal troubles. However, in this case, the language in the bailout includes a very strong clause about cryptocurrencies.

What's notable about this is the language of financial safety and stability:

To further safeguard financial stability, we are taking important steps to (i) discourage the use of crypto-currencies with a view to preventing money laundering, informality and disintermediation

To the actual substance of the claims:

Does crypto facilitate money laundering?

- A blockchain is a public ledger of every transaction so simply using a blockchain to conduct money laundering operations makes transactions more public, not less. Sure there are mixers, but as Laura Shin's analysis of the DAO hack points out, there are various forensics tools (like the Chainalysis tool) that can be used to track and identify the origin of transactions.

Does crypto facilitate "informality" in transactions?

- I don't even know what this means...Does cash facilitate informality in transactions?

Does crypto disintermediate banks?

- Absolutely. But that's a feature not a bug. After the 2015 election where President Macri was elected he began a path of economic reforms to address the failed Kirchner policies. Kirchner had relied on unorthodox financing tools such as money printing and coercing domestic banks to buy government bonds. Marci, on the other hand, shifted to borrowing from the international capital markets. In the long run, if banks were to be disintermediated, the tactic of issuing debt and forcing private banks to hold some of this debt on their balance sheet would no longer be viable.

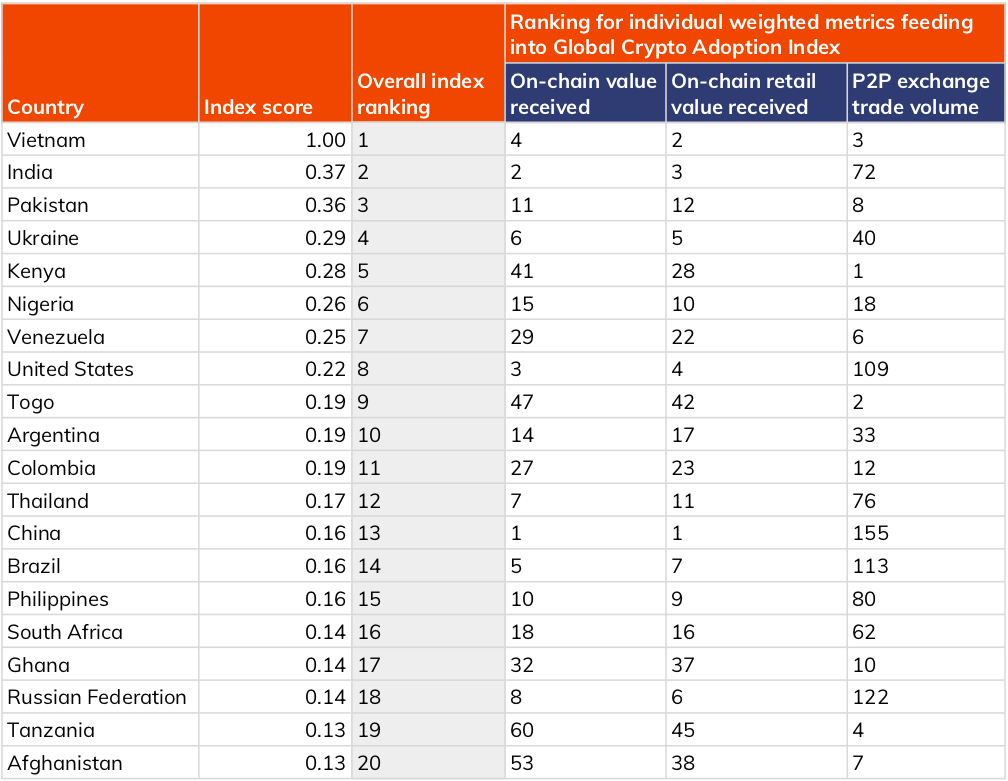

What are the potential motivations for the IMF adding a clause like this into the terms of their loan? A good place to start would be the global crypto adoption statistics which show that Argentina has one of the strongest rates of crypto adoption in the world sitting at #10. After years of enduring fiscal mismanagement and real hyperinflation, it's no surprise that Argentinians have started looking for other ways to both transact and store wealth. Banks are afraid that they will be circumvented and the IMF is afraid that they won't be able to force Argentina to do what they want.

Since banks play a key role in the disbursement of IMF funds, it's no surprise that they have helped to create this unholy alliance aimed at raising the gates and keeping crypto from storming the castle.

The IMF was originally created to build a framework for international economic cooperation in the aftermath of WW2. Today, the institution functions more as a combination between a loan shark and a mob boss and anything that threatens its power must be kneecapped. Of course if you have a track record as poor as Argentina's public/private banks, you'd want to do anything to keep out competitors because consumer choice means almost certain demise. For its part, crypto needs to be seen as a safe, neutral haven for Argentinians to hold onto their purchasing power. With a groundswell of support from the broader population, instituting these kinds of restrictions will be extremely tough for the politicians (however corrupt) to prohibit.