How To Evaluate Stablecoins

The simplest way of reasoning about a stablecoin is to understand the design decisions around centralization and collateralization.

“To be successful, money must be both a medium of exchange and a reasonably stable store of value. And it remains completely unclear why BitCoin should be a stable store of value. When I try to get them to explain to me why BitCoin is a reliable store of value, they always seem to come back with explanations about how it’s a terrific medium of exchange. Even if I buy this (which I don’t, entirely), it doesn’t solve my problem. And I haven’t been able to get my correspondents to recognize that these are different questions.” — Paul Krugman (2013)

Writing in 2013, back when Bitcoin was the only cryptocurrency on the block, Paul Krugman pointed out that in order for a cryptocurrency to become a successful form of money it needed to be both a medium of exchange as well as a stable store of value. Looking at the price fluctuations of Bitcoin over the past 8 years, it’s hard to say he was wrong.

However, during that time the crypto community clearly recognized the need for a price stable cryptoassets which became known as “stablecoins.” As the name suggests, stablecoins are designed to ensure price stability relative to a specified peg.

As of May 2021, the total market capitalization for stablecoins is approaching $100bn and they have found a variety of applications specifically in the burgeoning “Decentralized Finance” market. Stablecoins are one technology that will help crypto bridge the gap between early crypto adopters and more mainstream users and understanding the world of stablecoins is a prerequisite to understanding how “Decentralized Finance” operates. The simplest way of reasoning about a stablecoin is to understand the design decisions around centralization and collateralization.

Use Cases

Before diving into the parameters in the stablecoin design space, let’s talk about use cases and why one might want a stablecoin. Money has three functions: it needs to be a store of value, a unit of account, and a medium of exchange. Stablecoins give you the native benefits of digital currencies while tamping down the volatility that is inherent in cryptoassets.

- Ease of Transacting. Rather than having to constantly think about the price of an arbitrary asset in BTC and then convert to dollars and then having to update this every time the price of BTC changes, you can now just denominate things in dollars, Yen, Swiss Franc, or whatever your home currency is.

- Speed of Execution. Because of the time delays that you incur whenever you touch the ACH rails, traders are using stablecoins to avoid the fiat system altogether. As Joey Krug said on a recent podcast, “Most of the time when we’re trading these days, we rarely go back to actual US dollars. If we wanted to sell something for fiat, we’d sell it for USDC and not even have to touch the banking rails.”

- Make your Illiquid Holdings Liquid. Let’s say you have a massive amount of ETH which you purchased a long time ago and you think the price is still going to rise. You may need liquidity for some reason but may not want to liquidate your ETH holdings in which case you can stake your ETH and get a loan denominated in a stablecoin. This is technically feasible with traditional financial rails, but if you look at a site like TD Ameritrade you can see that you’ll need ~\($75\)k in order to be eligible.

- Remittances. In many countries without stable monetary systems, they know USD and stablecoins enable locals to plug into the cryptoverse and hold these pegged cryptoassets. Indeed, even Bitcoin maximalist Peter McCormack said that his biggest takeaway from a recent trip to Venezuela was that there’s more demand for USD than their is for Bitcoin: “I will get a slap from the Bitcoin gods for saying this but there’s more of a purpose for day-to-day survival and ease of use in a digital US dollar than there is for Bitcoin.”

Stablecoin Design Parameters

The basic purpose of a stablecoin is to dampen the volatility of cryptoassets and give users a digital native currency that holds its value relative to a specified peg. In this section I’ll talk about the different design decisions stablecoins can make. From there, I’ll show a simplified model for how to think about where various stablecoins sit relative to each other.

The simplest stablecoin you could have is one where you put $\(100\) in a bank and then issue 100 tokens, each of which is worth $\(1\). In this case, we have specified the peg as the US Dollar (USD). To maintain trust in the system, you will need an auditor to come in and verify that indeed you have $\(100\) in the bank. As for maintaining the peg, there are two situations to consider: 1) the price of the stablecoin is below $\(1\) and 2) the price of the stablecoin is above $\(1\).

- If the price of the stablecoin dips below $\(1\) you’d expect the marginal trader to redeem the stablecoin for the underlying collateral since they could get $\(1\) for less than $\(1\). This would contract the supply of the stablecoin, bringing the price back to the peg’s equilibrium.

- If the price of the stablecoin goes above $\(1\), you’d expect the marginal trader to send money to the stablecoin protocol which would allow them to make a purchase for more than $\(1\) for $\(1\). This would expand the supply of the stablecoin, brining the price back to the peg’s equilibrium.

In this example, there are a couple notes from a design standpoint. First, we are relying on an auditor to help maintain trust in the system. Sure, the bank is reputable and the auditor is from a top public accounting firm. But how do you know? The answer is you don’t know for sure. In fact, back in 2019, it was uncovered that Tether (now the largest stablecoin with a market cap of $\(52 \text{bn}\)) said that they were fully collateralized when in fact they were only 74% collateralized. Second, we are using US Dollars but what if we want a different peg? Third, how long would it take to redeem if I wanted dollars for my stablecoin?

Trilemma Model

All of these questions help motivate the discussion of the different design choices a stablecoin needs to make. To better understand the trade-offs a system needs to make some have used a variant of Triffin’s Trilemma (free capital mobility, exchange-rate management, and monetary autonomy) to explain the trade-offs in stablecoin design decisions. They argue that in a stablecoin system, you have collateralization, decentralization, and capital efficeincy and you can get two but not all three:

“Stablecoins, as they exist today, have their own impossible Trilemma (you can only have 2 of 3 when building the project). The three sides consist of 1) Collateralization 2) Decentralization and 3) Capital Efficiency. Moving around the triangle as the diagram below shows will allow a project to fit into one of the three stablecoin categories: Fiat/Asset Backed, On Chain Crypto Collateralized or Seigniorage based.” — The State of Stablecoins, 2019

“Moin” Model

A more comprehensive description of various stablecoin designs comes from Moin, Gün Sirer, and Sekniqi (Moin et al.). They suggest a framework for classifying stablecoin designs which centers on 4 design aspects: 1) the peg, 2) the collateral, 3) the price adjustment mechanism, and 4) how the system gets price information.

Peg: What is the system going to be pegged to?

Stablecoins are designed provide stability and the peg is simply refers to the point about which you are providing stability. In our earlier example, because we had $\(100\) in the bank and had issued 1 coin per dollar, we would say that this is pegged to the dollar. However, a peg isn’t limited to dollars. We could peg a stablecoin to other fiat currencies like the Euro, Yen, or Swiss Franc. We could also peg the stablecoin to a commodity like gold or to an index like the CPI.

- Fiat: US Dollars, Euro, Yen, Franc

- Commodity: Gold

- Combination: IMF Special Drawing Rights (SDR)

- Index: CPI

Collateral: What type of collateral will the system accept and is the level of collateralization that underpins the system?

Underpinning the value of gold is that if all else fails you can use it to make pretty things. Underpinning the value of the dollar is a combination of (a) the fact that you can use them to pay your taxes to the U.S. government, and (b) that the Federal Reserve is a potential dollar sink...Placing a ceiling on the value of bitcoins is computer technology and the form of the hash function… until the limit of 21 million bitcoins is reached. Placing a floor on the value of bitcoins is… what, exactly? — Brad Delong (2013)

Collateral refers to the assets that back up the stablecoin system. Here, it’s worth going back to US monetary history to provide an analogue. The Bretton Woods era came about in 1944 when 44 countries came together with the goal of creating a system of foreign exchange which they did by pegging participating currencies to the dollar which in turn was pegged to gold. This system lasted until February 1973 when the dollar was devalued to $42.22/oz. Finally in March of 1973, the system of fixed exchange rates collapsed and currencies floated against each other.

In other words, the monetary history of the United States was one of increasingly abstract money. Previously we had a commodity like gold collateralizing the dollar and ultimately moved to a world where there was no collateralization (but for the fact that you can pay taxes in this currency).

The same principles hold with stablecoins. When dealing with collateral the key is whether you have it or not. If the system takes collateral, then there are various types of collateral that it could take including fiat, commodities, crypto. Alternatively it could have no collateral behind it like the US dollar after March 1973.

If the system is collateralized, you then need to make a decision about how much collateral it will take. There are four options: overcollateralization, full collateralization, partial collateralization, and no collateralization.

In the earlier example where you had $\(100\) in a bank account and issued 100 coins each worth $\(1\), you would have a system that is fully collateralized because for each coin in the system it is backed up by $\(1\) in a bank account. Partial reserve means that the total level of collateralization is not one-to-one but rather you have more stablecoins outstanding than hard assets backing up the coins. Tether, which was supposed to be fully collateralized but was only 74% collateralized is an example of a partial reserve.

Overcollateralization is a technique you use if the underlying collateral that the system can take is highly volatile so you need some margin of safety in case the value of the collateral drops. Dai and its 150% collateralization ratio is a good example of this. Finally, we have the mythical non-collateralized stablecoin which — as the name suggests — is not backed by any collateral.

Type of collateral

- Fiat: put dollars in a bank vault and have someone audit it like USDC

- Commodity: harder than fiat collateral because there are fewer institutions which accept and insure commodity deposits

- Crypto: Maker uses this approach but it’s complicated because of the volatility inherent in the crypto markets

- None: This is kind of the holy grail for crypto but it’s not at all clear whether it can actually be accomplished. Not having collateral makes things easier but you’re subject to the whims of a market and there’s little to the price stable.

Amount of collateral

- Full Reserve: Here every unit of cryptocurrency can be redeemed for the underlying asset and theoretically, the price of the cryptocurrency should not deviate from the underlying asset. Stablecoins in this category have a 1:1 ratio between stablecoin and collateral.

- Partial Reserve: Like the USD which went from gold standard → full fiat these will start more collateralized and then taper off the collateral ratio over time. Stablecoins in this category have a >1:1 ratio between stablecoins and collateral.

- Overcollateralized: This means that you keep more than the value of the circulating currency in reserve to guard against price swings in the collateral. Stablecoins in this category have a 1:>1 ratio between stablecoins and collateral.

- None: Here the protocol will try to expand supply of a currency when the price is too high and contract the supply when the price is too low.

Price Adjustment Mechanism: When the price of the stablecoin deviates from the peg, how will the system bring things back into equilibrium?

This topic is going to need to be its own separate post but basically the question is by what mechanism does the stablecoin maintain its peg. When maintaining price for a stablecoin, there are 4 main scenarios to keep in mind: whether the price is above or below the peg and whether demand is low or high and any adjustment mechanism needs to make sure that the protocol properly incentivizes coin holders in each scenario.

Some of these adjustment mechanisms are listed below:

- Reserve of Backed Asset: Mechanism where users are incentivized to expand/contract the supply until the price returns to the peg. In a fully collateralized dollar system if the price of the stablecoin goes below $\(1\), you want stablecoin holders to redeem the coin for the collateral because they get a dollar for less than a dollar, the supply contracts, and you clear the market. If they price goes above $\(1\), you want users to expand supply of the stablecoin.

- Dual Coin: this is a stablecoin which basically absorbs the volatility of the first. A spin on this is the triple coin system where you have a bond token and share tokens (see Basis).

- Algorithmic: This uses a purely algorithmic approach to adjust the supply of the stablecoin in response to price fluctuations.

- Leveraged Loans: Users lock collateral in collateralized debt positions and then can mint a currency (like Dai). You unlock collateral by paying back the borrowed currency plus a stability fee that accrues over time.

Price Information: How does the system get a data feed about price information necessary to calibrate the system?

Blockchains contain information about their state but importing non-native data to a blockchain is extremely complex. The main piece of data that a stablecoin needs to understand is price. Unfortunately, there are thousands of exchanges all over the world so figuring out which data feed to trust is a problem since a single entity that is relied on for the answer to everything can easily abuse the system.

- Oracle: You have an agreed upon external feed(s) which tells you the answer you are looking for

- Voting: Here you might have a crowd say what they think the price is going to be and have some kind of a penalty if your response is too far from the median. Issue is this can lead people to vote how they think other people are going to vote.

Stablecoin Mental Model

“It can scarcely be denied that the supreme goal of all theory is to make the irreducible basic elements as simple and as few as possible without having to surrender the adequate representation of a single datum of experience.” — Albert Einstein

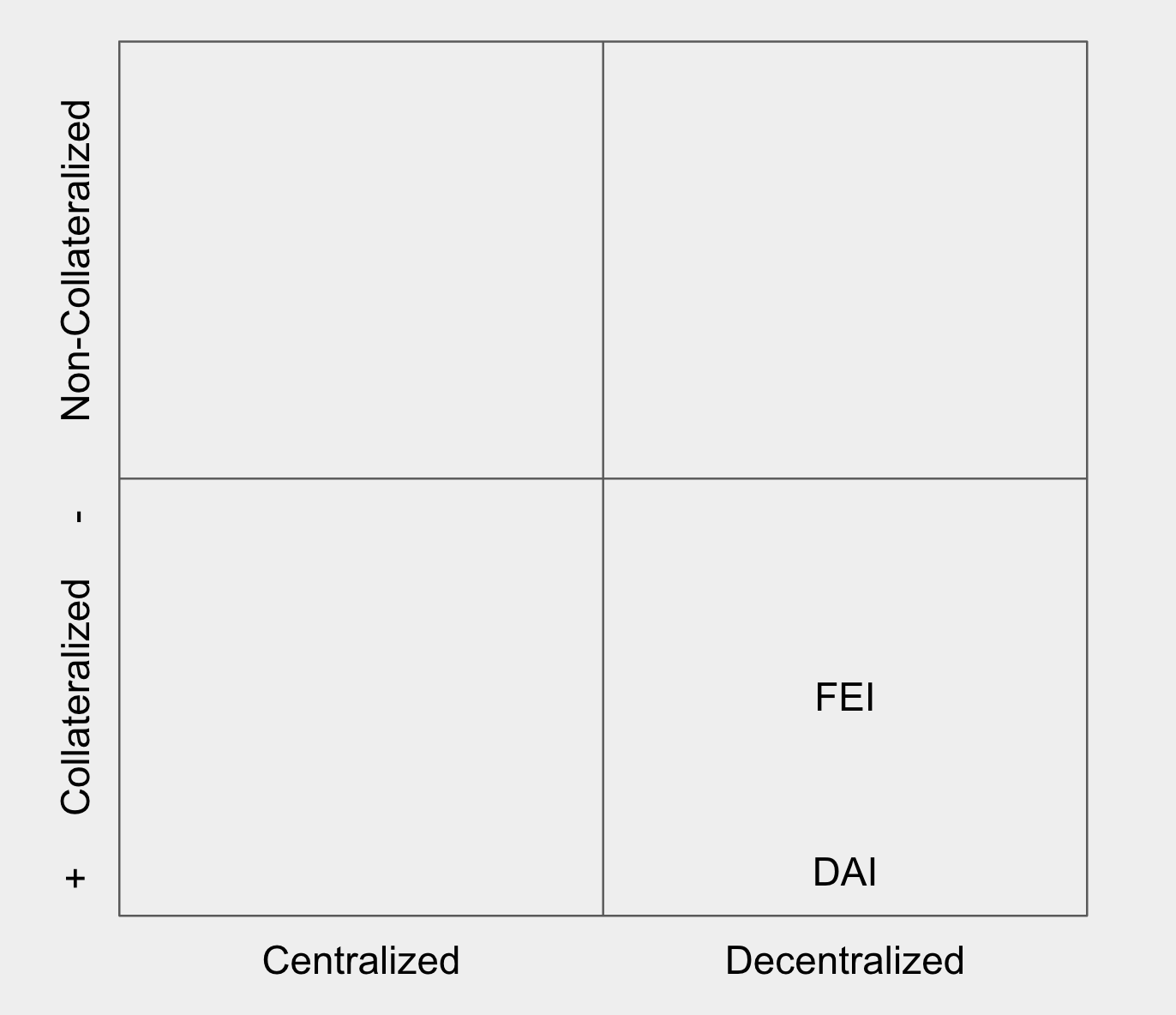

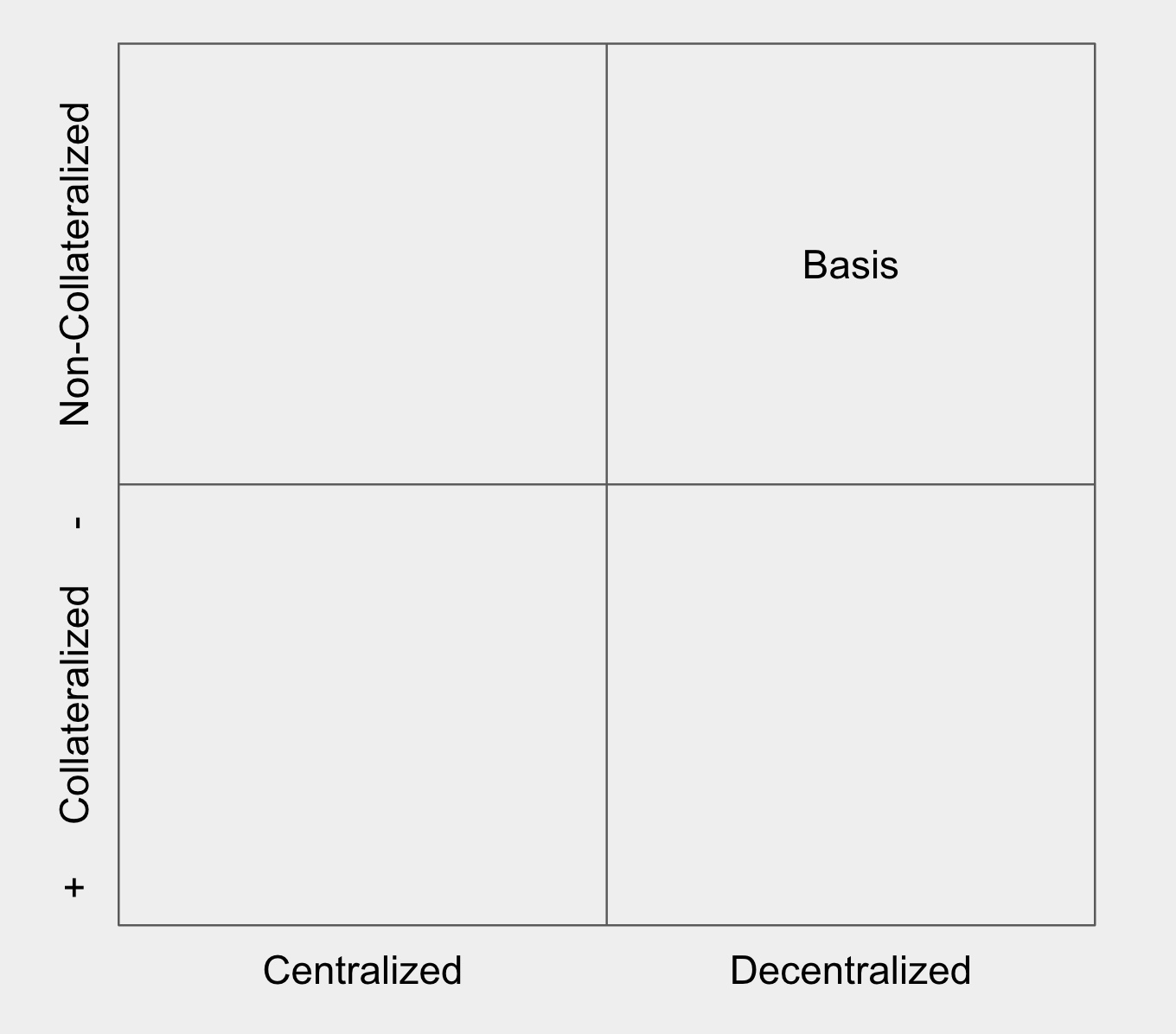

While the two models presented above are useful when thinking more deeply about stablecoin design decisions, the simplest way to understand stablecoins is to think of them on a 2x2 matrix of centralization/decentralization and collateralized/non-collateralized.

Before we dive in to talk about stablecoins, it’s instructive to consider two non-crypto examples.

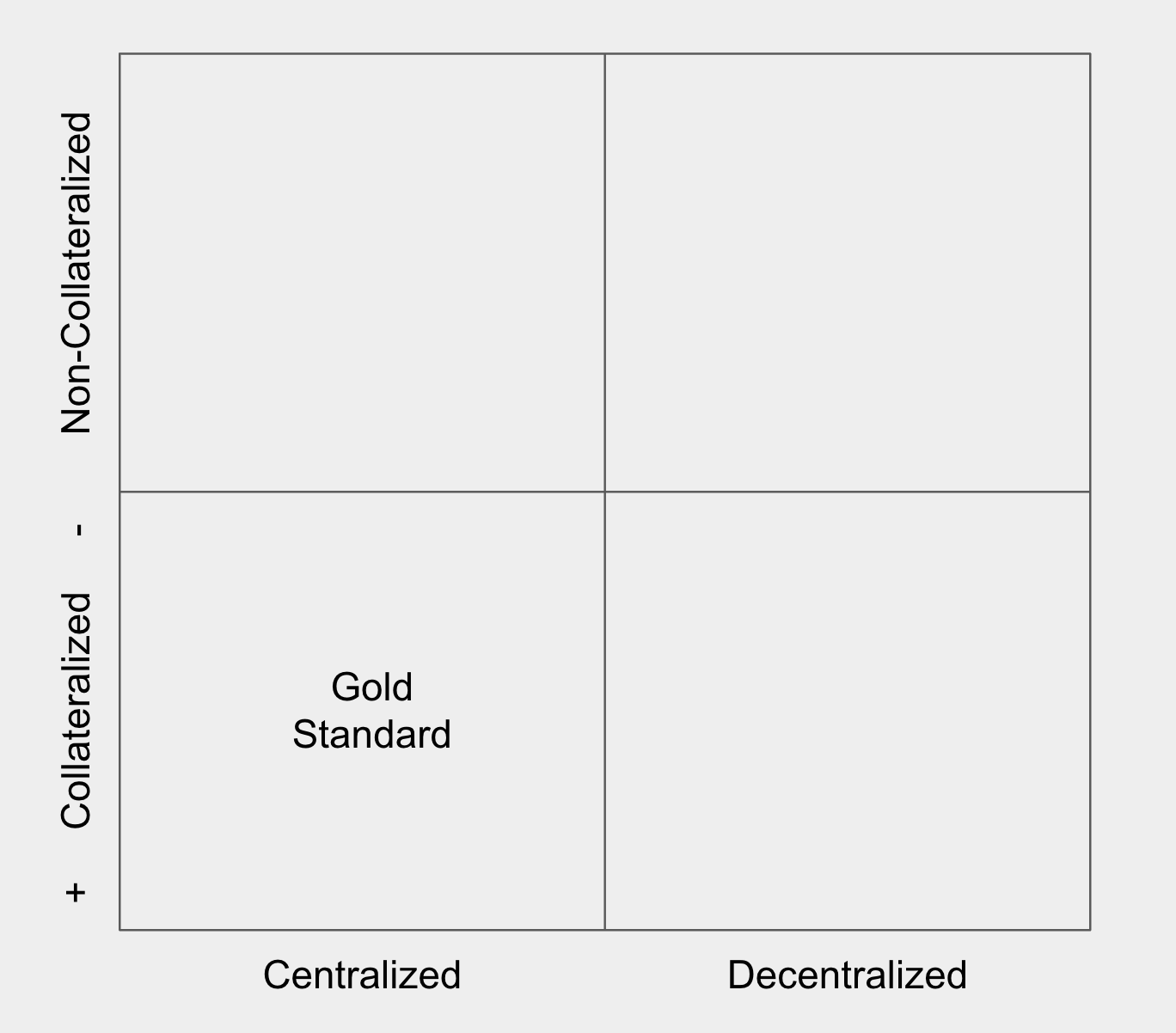

Gold Standard

Under a Gold Standard, a country issues dollars which are collateralized by an underlying precious metal (in this case gold). In the case of the Bretton Woods Agreement, international currencies were pegged to the dollar which in turn was pegged to gold at $\(35\text{/oz}\). In this case, we would say that the gold standard is both centralized and collateralized.

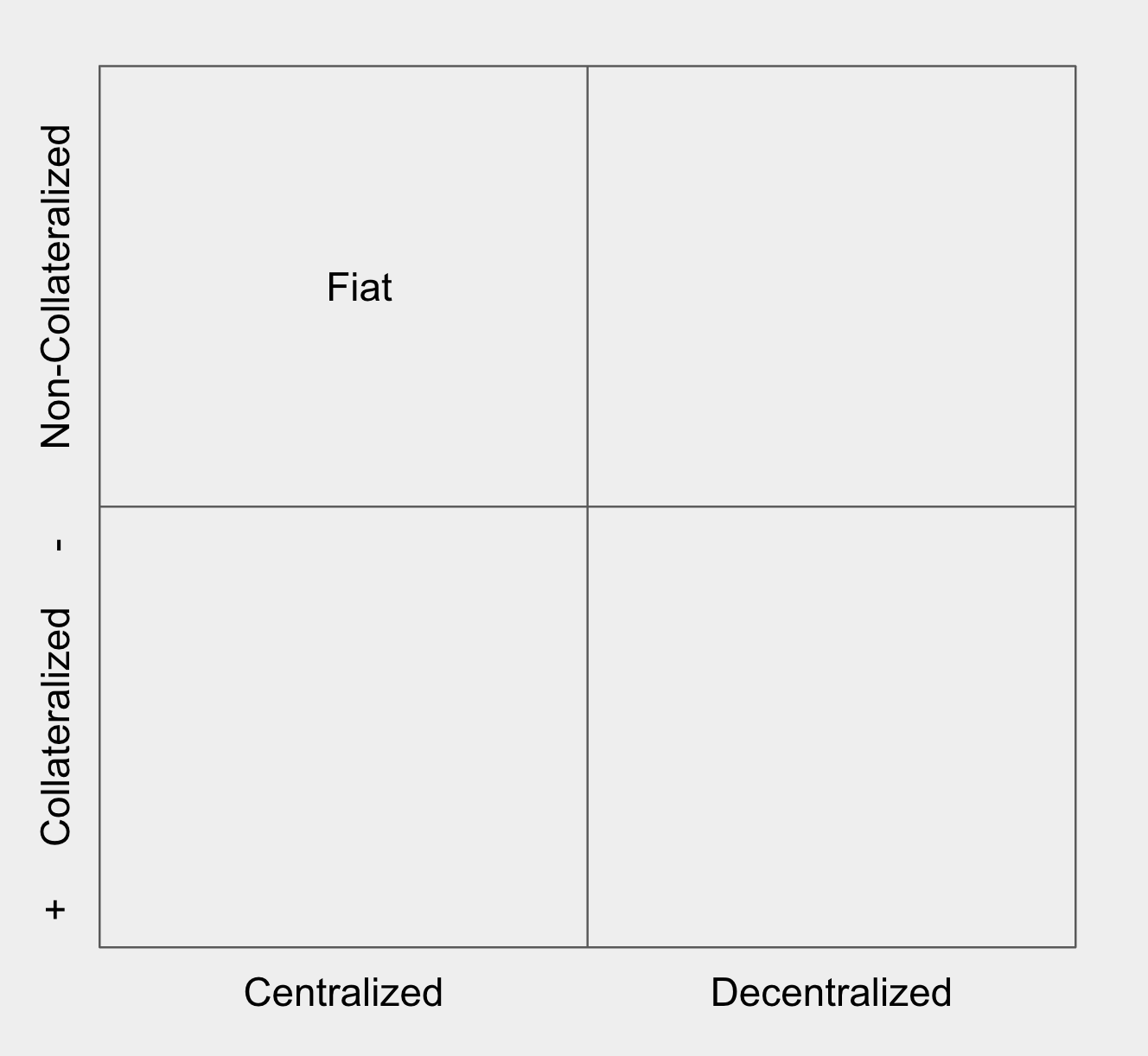

Floating Fiat Currency

In April 1971, the U.S. balance of trade turned into a deficit and in August President Nixon announced that he would “suspend temporarily the convertibility of the dollar into gold or other reserve assets.” By removing the direct convertibility of U.S. dollars into gold the US abandoned the gold standard which was the first nail in the coffin of the Bretton Woods system. After this, the adjustable peg fell less than two years later. This led to a monetary regime in which the value of the currency was not based on any physical commodity but instead was allowed to fluctuate dynamically against other currencies on the foreign-exchange market.

Fiat, which derives from the Latin phrase “fieri,” meaning an arbitrary act or decree, meant that the money had value because the government decreed that it had value. Because you can’t exchange fiat currency for anything, it’s considered centralized and non-collateralized.

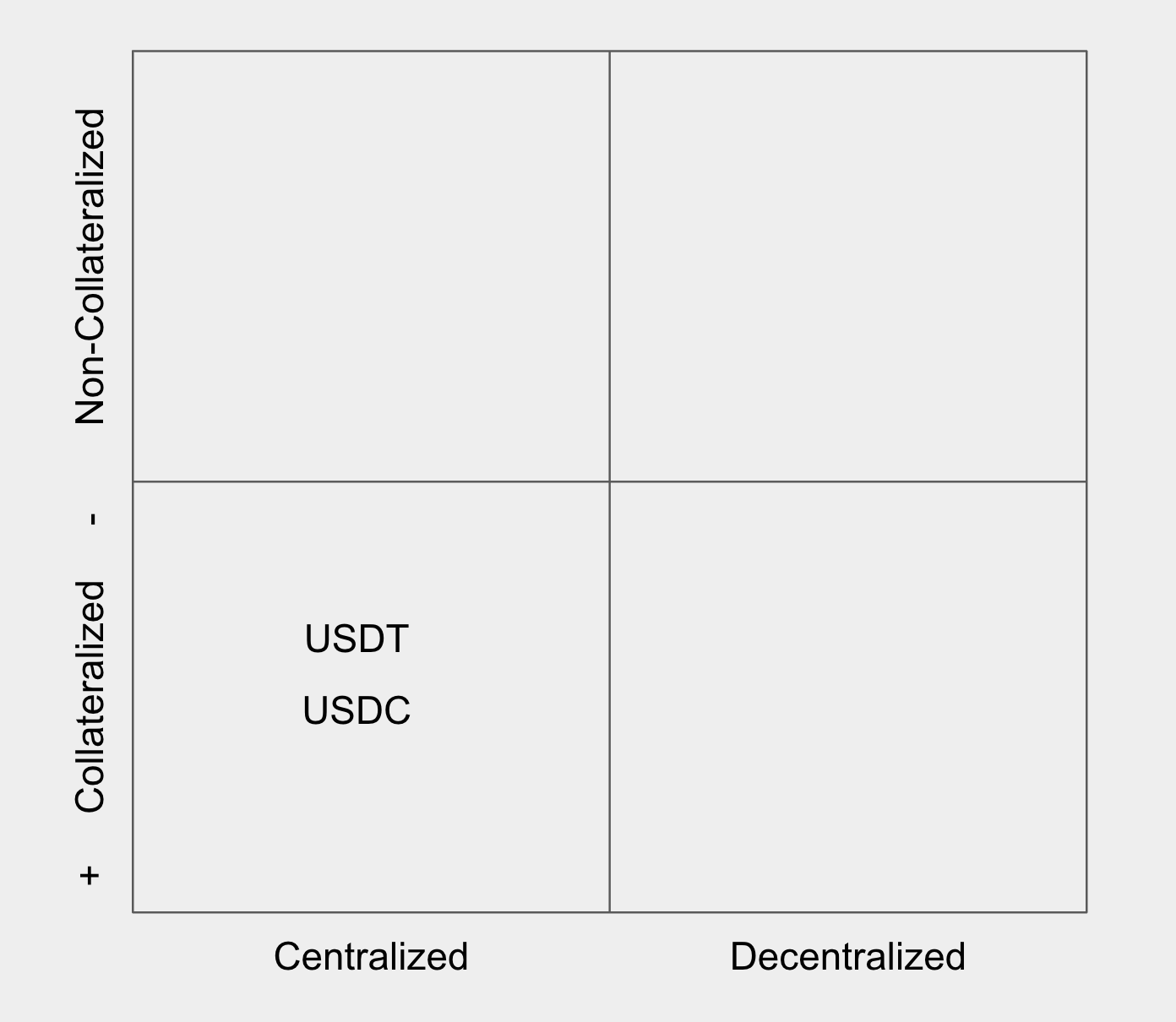

Centralized, Collateralized Stablecoins

A centralized, collateralized stablecoin is one where a company puts some collateral in a bank account and issues tokens against the collateral. There are varying degrees of collateralization which Moin et al. refer to as “Full Reserve” and “Partial Reserve” schemes but put simply, these systems have a trusted custodian that lets anyone with a stablecoin redeem it for the underlying collateral.

- Pro: These systems are simple and stable because you can redeem for the underlying dollars.

- Con: These systems are completely centralized and you lose the benefits of the blockchain when you do this.

Consider USDC which is Circle’s digital dollar stablecoin and USDT which is Tether’s dollar-pegged stablecoin:

- As USDC notes on their website, USDC is issued by “regulated financial institutions, backed by fully reserved assets, redeemable on a 1:1 basis for US dollars, and governed by Centre, a membership-based consortium that sets technical, policy, and financial standards for stablecoins.” In order to ensure that Centre holds the requisite deposits to maintain the 1:1 peg, they rely on monthly attestations by Grant Thornton. Because of the trusted third-party model it is a centralized coin and because the system is fully collateralized, it’s at the bottom of the graphic.

- Tether’s digital dollar is currently the most popular stablecoin with a market cap of $53.5bn. Tether is [in]famous for claiming that each token in the system was backed by 1 US dollar when in reality the system was only 74% backed by cash and equivalents which makes it a “Partial Reserve” stablecoin. So while it’s still centralized, it is slightly less collateralized than a stablecoin like USDC as shown in the matrix.

Decentralized, Collateralized Stablecoins

A decentralized, collateralized stablecoin is a stablecoin which does not rely on a trusted custodian to add and store collateral to the system. Rather, there’s a decentralized smart contract system that can automatically store collateral assets and then uses those collateral assets to back up the value of the stablecoin. One way of thinking about this is that it’s like a Gold Standard with arbitrary collateral.

- Pro: There’s a high degree of decentralization and because there’s no custodian, you can get real-time audits of collateral which you cannot do with, say, USDC whose audits happen monthly.

- Con: Some of the collateralization schemes makes scaling these systems very capital-intensive

The most prominent of the decentralized, collateralized stablecoins is DAI which takes cryptocurrency as collateral and issues DAI against the collateral. The reason that it is at the bottom of the graph is that DAI uses overcollateralization in order to give the system a sufficient margin of safety in the event the price of the underlying collateral drops.

As Rune Christensen explained, in Maker if you have $\(200\) in ETH and want a $\(100\) loan you will stake your ETH and receive DAI. The system has a liquidation ratio of \(150\%\) so if the value of your collateral dips below $\(150\), the collateral will immediately be liquidated. Because of this, DAI is said to be decentralized and overcollateralized.

Because of the level of capitalization needed to support systems like DAI, there have been many teams playing around with novel ways of reducing the level of collateralization. One recent experiment, FEI, was collateralized to the tune of $\(1.2\) billion dollars and tried to maintain a peg to USD by algorithmically buying and selling supply to maintain the price. FEI tried to add direct incentives which punished you for selling FEI the more the price diverged from the peg. In fact, this burn mechanism gets exponentially worse as the price moves away from the peg. Unfortunately, the peg didn’t hold and FEI dropped to a low of 32% off its peg.

Decentralized, Non-Collateralized Stablecoins

Finally we make our way to the unicorn of all stablecoins, the decentralized, non-collateralized stablecoin. Non-collateralized, decentralized stablecoins essentially have an algorithm which will print and burn stablecoins but there will be no collateral behind the system.

- Pro: This is basically digital money that isn’t minted by a government

- Con: It’s not backed by anything so it could collapse quickly. Also, as we saw with Basis, the regulatory landscape for something like this is quite challenging.

Conclusion

Stablecoins are cryptoassets that are designed to ensure price stability relative to a specified peg. Stablecoins have exploded in popularity in part because they provide crypto-native assets that have price stability unlike other assets like Bitcoin or Ethereum. The easiest mental model for reasoning about stablecoins is to think about whether the coin is collateralized/non-collateralized and if it is centralized/decentralized. From there, we can employ more complex models like Moin et al.’s stablecoin design classification framework to understand the more complex technical technical trade-offs being made.

Sources

- a16z. 2018. “A Skeptic’s View of Crypto (from the Point of View of Monetary Economics).” YouTube Video. YouTube. https://www.youtube.com/watch?v=Y_IYGeZLLhI&t=1374s.

- “An Introduction to Stablecoins for Banks and Fintechs.” 2021. Algorand.com. 2021. https://www.algorand.com/resources/blog/stablecoins-for-banks-and-fintechs.

- Binance Academy. 2019. “Stablecoin.” Binance Academy. Binance Academy. February 6, 2019. https://academy.binance.com/en/glossary/stablecoin.

- “Bitcoin Is Evil.” 2013. Paul Krugman Blog. December 29, 2013. http://web.archive.org/web/20210306082240/https://krugman.blogs.nytimes.com/2013/12/28/bitcoin-is-evil/.

- BitMEX Research. 2018. “A Brief History of Stablecoins (Part 1) | BitMEX Blog.” Bitmex.com. July 2, 2018. https://blog.bitmex.com/a-brief-history-of-stablecoins-part-1/.

- Dale, Brady. 2021. “Coinbase, Naval, Framework Ventures Back $19M Raise for a Capital-Efficient Stablecoin - CoinDesk.” CoinDesk. CoinDesk. March 8, 2021. https://www.coindesk.com/coinbase-naval-framework-ventures-19m-raise-fei-stablecoin.

- Dale, Brady. 2021. “$1B Fei Stablecoin’s Rocky Start Is a Wake-up Call for DeFi Investors - CoinDesk.” CoinDesk. CoinDesk. April 7, 2021. https://www.coindesk.com/1b-fei-stablecoins-rocky-start-is-a-wake-up-call-for-defi-investors.

- DeLong, Brad. 2013. “Washington Center for Equitable Growth | Watching Bitcoin, Dogecoin, Etc….” Archive.org. 2013. https://web.archive.org/web/20140405013624/http://equitablegrowth.org/2013/12/28/1466/watching-bitcoin-dogecoin-etc.

- Haseeb Qureshi. 2018. “Stablecoins: Designing a Price-Stable Cryptocurrency.” Hackernoon.com. February 10, 2018. https://hackernoon.com/stablecoins-designing-a-price-stable-cryptocurrency-6bf24e2689e5.

- Lunn, Bernard. 2020. “Why StableCoins Are so Important (but Also so Hard to Get Right) - Daily Fintech.” Daily Fintech. December 31, 2020. https://dailyfintech.com/2020/12/31/why-stablecoins-are-so-important-but-also-so-hard-to-get-right-2/.

- Moin, Amani, Sirer, Emin Gün, and Kevin Sekniqi. 2019. “A Classification Framework for Stablecoin Designs.” ArXiv.org. 2019. https://arxiv.org/abs/1910.10098.

- Real Vision Finance. 2021. “Portfolio Construction: Beyond BTC & ETH (W/Jeff Dorman, Joey Krug, Ari Paul, and Raoul Pal).” YouTube Video. YouTube. https://www.youtube.com/watch?v=EBRVeki7zKo.

- “The State of Stablecoins.” 2019. https://www.blockchain.com/ru/static/pdf/StablecoinsReportFinal.pdf.

- Samman, George, and Andrew Masanto. n.d. “The State of Stablecoins 2019 Hype vs. Reality in the Race for Stable, Global, Digital Money Lead Author Co-Author.” Accessed May 4, 2021. https://static1.squarespace.com/static/564100e0e4b08c9445a5fc5d/t/5c71e43ef9619ae6c83c30af/1550967911994/The+State+of+Stablecoins+2019_Report+2_20_19.pdf.

- Sams, Robert. 2014 “A Note on Cryptocurrency Stabilisation: Seigniorage Shares.” Accessed May 4, 2021. https://blog.bitmex.com/wp-content/uploads/2018/06/A-Note-on-Cryptocurrency-Stabilisation-Seigniorage-Shares.pdf.

- SE Daily. 2019. “Stablecoins with Rune Christensen - Software Engineering Daily.” Software Engineering Daily. April 3, 2019. https://softwareengineeringdaily.com/2019/04/03/stablecoins-with-rune-christensen/.

- “Stablecoin Use Cases on Algorand: Here’s What’s Possible.” 2021. Algorand.com. 2021. https://www.algorand.com/resources/blog/stablecoin-use-cases-on-algorand.

- What Bitcoin Did. 2020. “The Role of Stablecoins with Jeremy Allaire.” YouTube Video. YouTube. https://www.youtube.com/watch?v=DVxRMLa3CUE.