Boom and Bust: A Global History of Financial Bubbles

To have fire, you need oxygen, fuel and heat. To have a bubble, you need marketability, money/credit and rampant speculation.

"Although fairly uncommon in the history of financial markets, major speculative bubbles have been known to occur from time to time, often with ruinous effects." – PBS Frontline

There is a sense that financial bubbles – once infrequent affairs – have become more frequent. Indeed, since the 1980s, we have seen 4 major bubbles: the Japanese Bubble, the Dot-Com Bubble, the Subprime Mortgage Bubble and the Chinese Stock Bubble. Given the periodicity of these crises, authors William Quinn and John Turner – both economics professors at Queen's University, Belfast – deem understanding the nature of bubbles to be both relevant and useful.

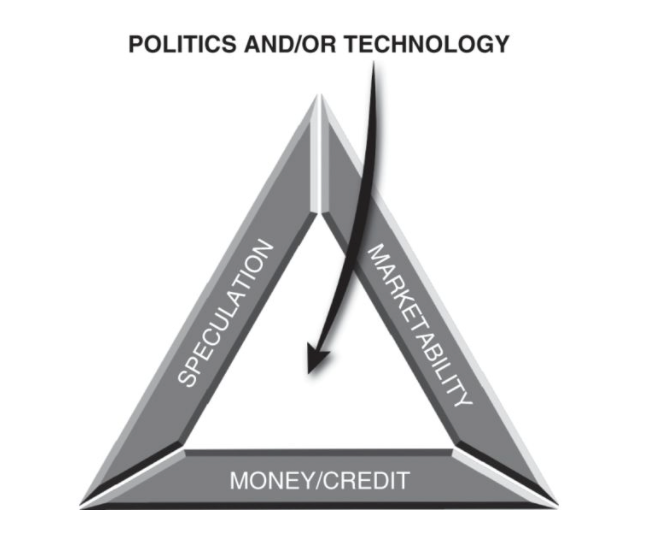

Boom and Bust: A Global History of Financial Bubbles examines the age old question of what causes bubbles and proposes a novel framework for evaluating the presence of a bubble based on the idea of a fire triangle.

This framework starts with the proposition that in order to have a fire, you need oxygen, fuel and heat. From there, they argue that fires are actually analogous to how bubbles form and that the necessary conditions for a bubble include marketability, money/credit, and speculation.

The starting point of our metaphor is to think of a financial bubble as a fire: tangible and destructive, self-perpetuating and difficult to control once it begins. While fires can cause serious damage, they can also be useful in certain ecosystems, contributing, for example, to the renewal of savannas, prairies and coniferous forests. The same is true of bubbles. Taking this metaphor further, the formation of a fire can be described in simple terms using the fire triangle, which consists of oxygen, fuel and heat. Given sufficient levels of these three components, a fire can be started by a simple spark. Once the fire has begun, it can then be extinguished by the removal of any one of the components. We propose that an analogous structure can be used to describe how bubbles are formed: the bubble triangle – Boom and Bust (p. 14)

Oxygen. The oxygen of the fire is analogous to marketability which is a general concept about how easily an asset can be freely sold.

- Marketability can be impacted by factors such as legality, divisibility of the assets, ease of finding buyers/sellers and how easy it is to transport the asset.

Fuel. The fuel of the fire is analogous to money and credit. Indeed, they claim "A bubble can form only when the public has sufficient capital to invest in the asset, and is therefore much more likely to occur when there is abundant money and credit in the economy."

- In markets with abundant capital, banks have other people's money that they can lend. This leads to bubble assets that can be purchased with borrowed money.

- In low interest rate environments, investors tend to reach for yield (think the Yield Pigs in the 1980s)

Heat. The heat of the fire is speculation which is simply buying an asset with the goal of selling it at a later date with a capital gain. While everyone wants assets they hold to increase in value, during bubbles "large numbers of novices become speculators, many of whom trade purely on momentum."

Using this framework the authors then catalogue the most major financial bubbles in history and analyze the primary causes and consequences. Notably, they do not include the Dutch Tulipmania of 1636-37 because "the price reversal was exclusively confined to a thinly traded commodity, with no associated promotion boom and negligible impact. In other words, the Tulipmania was too unremarkable to merit inclusion."

- 1719-1720: Mississippi Bubble (France)

- 1719-1720: South Sea Bubble (UK)

- 1720: Windhandel Bubble (Netherlands)

- 1824-1826: First Emerging Market Bubble (UK)

- 1844-1846: Railway Mania (UK)

- 1886-1893: Australian Land Boom (Australia)

- 1895-1898: Bicycle Mania (UK)

- 1920-1931: Roaring Twenties (USA)

- 1985-1992: Japanese Bubble (Japan)

- 1995-2001: Dot-Com Bubble (USA)

- 2003-2010: Subprime Bubble (USA, UK, Ireland, Spain)

- 2007, 2015: Chinese Bubbles (China)

The upside of this book is that it provides a simple 3 part test to determine whether an asset is exhibiting bubble-like behavior. As entertaining as Charles Mackay's Memoirs of Extraordinary Popular Delusions and the Madness of Crowds in 1841 is, this book provides a much-needed departure from his simplistic explanation that bubbles are simply a function of irrationality/madness.

If I were to provide any feedback, I'd like to see the beneficial aspects of various bubbles more explicitly called out and fairly analyzed. Take, for example, the Dot-Com bubble which had the effect of connecting vast swaths of the US population to the internet giving rise to the permissionless innovation we've seen on the internet. Indeed, it's safe to say that without the Dot-Com bubble, the odds that 72.3% of Americans would have a supercomputer in their pocket seem remote. Despite this, when analyzing the consequences of the Dot-Com boom/bust the authors claim:

"[I]t is not necessarily clear that the long-term consequences of internet technology will be positive. At the time of writing, it has become fashionable for the media to express concerns over its secondary social and political effects, such as misinformation, oligopolistic market structures and automation...We may be no better able to understand its impact than societies could understand how language or money would change the world in the decades after their creation"

A more sober analysis would point out that the internet fundamentally increases variance which means that we're likely to see more bad as well as good information. One need only look at our recent experience with COVID to understand the benefits (and drawbacks) of this bifurcated information ecosystem. To be sure, connecting the world is not an unmitigated good. But if the internet helps unlock more Ramanujans, it seems reasonable to suppose the pros far outweigh the cons.